does tennessee have estate or inheritance tax

How does inheritance tax work in Tennessee. Some states have inheritance tax some have estate tax some have both some have none at all.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

As of December 31 2015 the inheritance tax was eliminated in Tennessee.

. However there are additional tax returns that heirs and survivors must resolve for their deceased family members. It is one of 38 states with no estate tax. Tennessee is not impose an estate tax.

Tennessee is an inheritance tax and estate tax-free state. This is great news for residence. What Is The Inheritance Tax In Tennessee.

The net estate is the fair market value of all. Perfect answer Tennessee does not have an estate tax. Tennessee does not have an inheritance tax either.

No estate tax return must be filed. The Tennessee Inheritance Tax exemption is steadily increasing to 2 million in 2014 to 5 million in 2015 and in 2016 therell be no inheritance tax. You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets and any.

Technically Tennessee residents dont have to pay the inheritance tax. See where your state shows up on the board. Inheritance Tax in Tennessee.

In fact it doesnt matter the size of your estate there will be no state level tax assessed. Tennessee is an inheritance tax-free state. Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death.

Any amount gifted to one person over that limit counts against your. Tennessee does not have an inheritance tax either. Twelve states and the District of Columbia impose estate taxes and six impose inheritance taxes.

Those who handle your estate following your death though do have some other tax returns to take care of such. However it applies only to the estate physically located and transferred within the state between. What is the inheritance tax rate in.

Tennessee does not have an estate tax. A recent report from the Tax Foundation says in 2022 there are 12 states and DC with an inheritance or estate tax with one state Maryland having both. For any decedents who passed away after January 1 2016 the inheritance tax no longer applies to.

Hawaii and Washington State. There are NO Tennessee Inheritance Tax. For deaths in 2015 if the gross estate of a Tennessee resident has a value of more than 5 million the executor must file a state inheritance tax return.

For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply. See where your state shows up on the board. Maryland is the only state to impose both.

It is one of 38 states with no estate tax.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

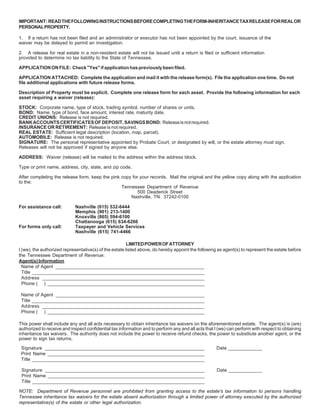

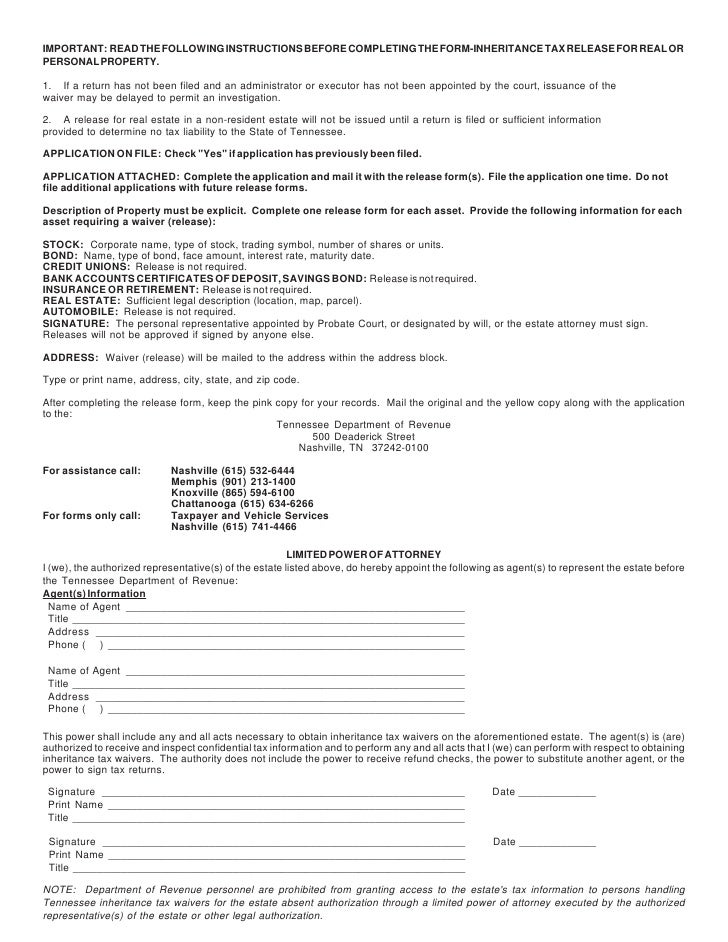

State Of Tn Inheritance Tax Fill Out And Sign Printable Pdf Template Signnow

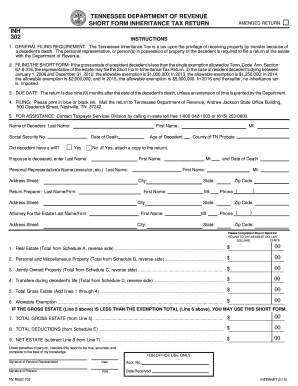

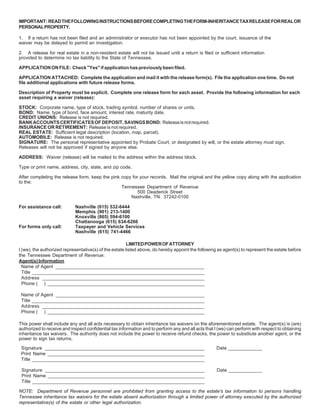

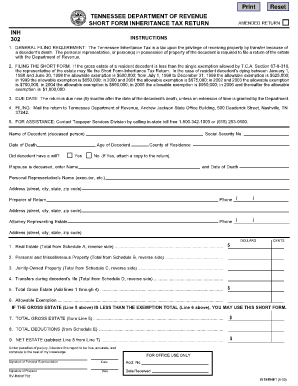

Fill In State Inheritance Tax Return Short Form

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Does Your State Have An Estate Or Inheritance Tax Tax Foundation Of Hawaii

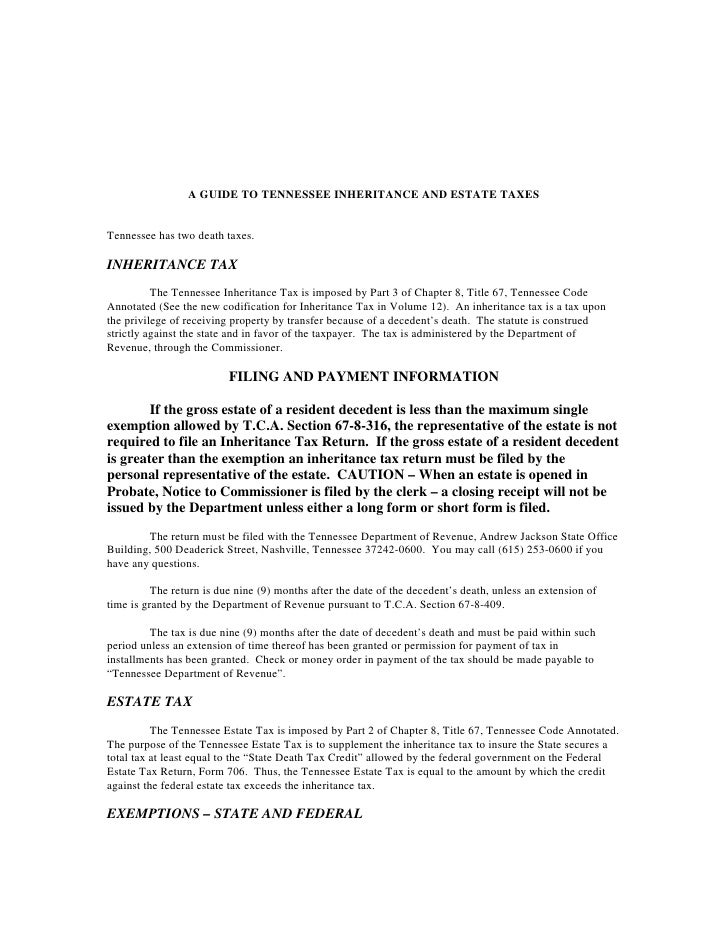

A Guide To Tennessee Inheritance And Estate Taxes

A Guide To Tennessee Inheritance And Estate Taxes

A Guide To Tennessee Inheritance And Estate Taxes

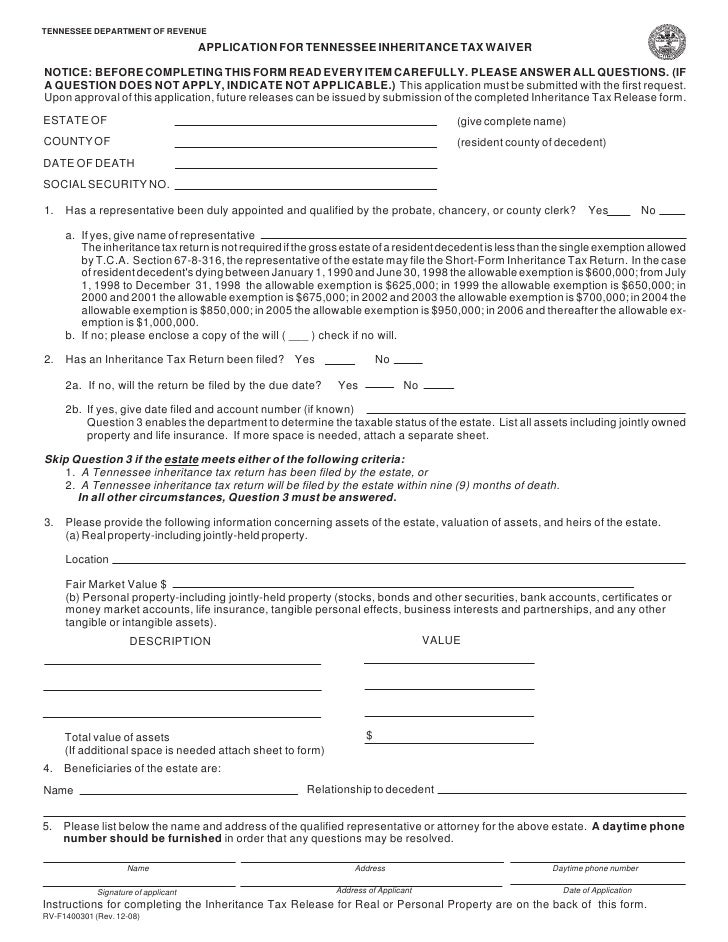

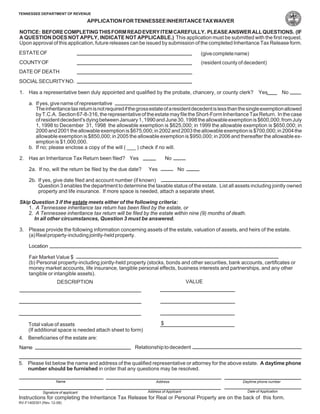

Affidavit Regarding Inheritance Tax Return

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Fill In State Inheritance Tax Return Short Form

State Estate And Inheritance Taxes Itep

A Guide To Tennessee Inheritance And Estate Taxes

Free Form Application For Inheritance Tax Waiver Free Legal Forms Laws Com

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Fillable Online Tn Tennessee Inheritance Tax Short Form Extension Fax Email Print Pdffiller