illinois taxes due date 2021

Friday October 1 2021. The due dates are.

Did You Know Certain Tax Return Due Dates Changed This Year Preservation Family Wealth Protection Planning

Penalties and interest on underpayments will be calculated from that date.

. Click here to get more information. This installment is mailed by January 31. Grocery Tax Suspension Required StatementSign - Effective July 1.

2021 Real Estate Tax Calendar payable in 2022 May 2nd. Elsewhere a county board may set a due date as late as June 1 The second installment is prepared and mailed by June 30 and is for the balance of taxes due. Individual taxpayers can postpone.

The filing deadline for 2021 tax returns is April 18 2022. June 27th 2022 for the 1st installment and September 6th 2022 for your 2nd installment. The payment deadline is also April 18 2022.

Tuesday March 2 2021. Although second installment bills have been on time most of the last ten years a delayed mailing date this year could mean second installment property tax bills would not be due until after the start of 2023 about when taxpayers will pay next years first installment property. The 2021 payable in 2022 property taxes were mailed on June 3rd.

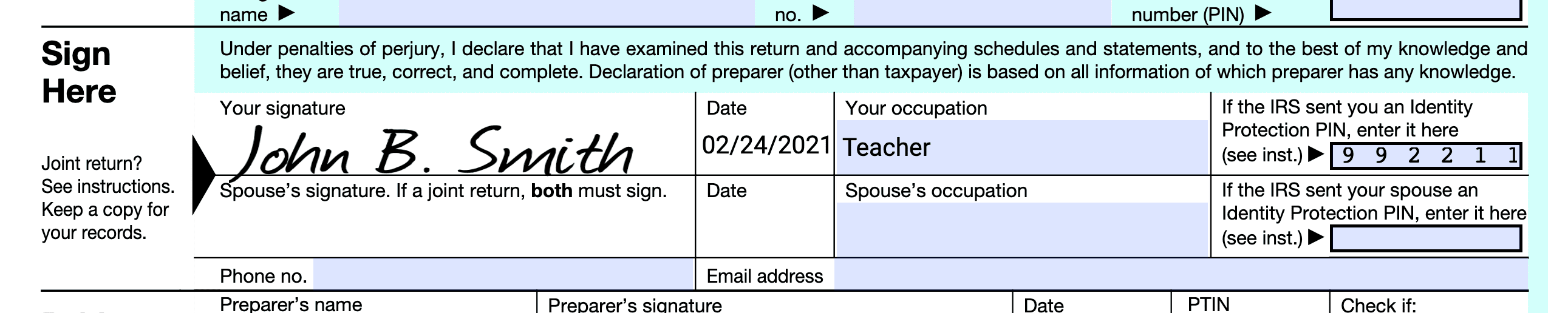

As a result affected individuals and businesses will have until May 16 to file returns and pay any taxes that were originally due during this period. On March 17 2021 the IRS announced that the due date for individuals to file their 2020 federal income tax returns eg Form 1040 1040-EZ will be automatically extended from April 15 2021 to May 17 2021. For tax year 2021 the filing deadline for Illinois income tax returns of taxpayers affected by tornadoes in December 2021 has been extended from April 18 2022 to May 16 2022.

Please call if you have any questions. DuPage County IL - 2nd Installment Property Tax Due Date. 042922 Property Tax bills are mailed.

Annual Tax Sale - Monday November 15 2020 at 9 AM. Among other things this means that affected taxpayers will have until. 2nd installment - Friday September 17 2021.

Tuesday March 1 2022. In Cook County the first installment is due by March 1. The State of Illinois has issued the following guidance regarding income tax filing deadlines for the 2021 tax year.

Tax Year 2021 First Installment Due Date. 2020 IRS and Illinois Income Tax Filing Season Extended to May 17 2021. Property tax rebates for homeowners earning less than 250000 -- or 500000 if filing jointly -- will be available in an amount equal to the property tax credit they qualified for.

This includes 2021 individual income tax returns due on April 18 as well as various 2021 business returns normally due on March 15 and April 18. The Illinois 2021 tax filing deadline has been extended until May 17 matching the IRS federal tax filing extension announced Wednesday. If you receive a federal extension of more than six months you are.

2020 payable 2021 Property Tax Due Dates. Last day to submit changes for ACH withdrawals for. Tax Year 2020 Second Installment Due Date.

The first due date is July 6th and the second due date is September 6thAny first installment taxes that are paid after July 6th will incur an Illinois State mandated 15 penalty per month any 2nd installment taxes that are paid after September 6th will also incur the state mandated 15. Illinois Department of Revenue Created Date. Late Payment Interest Waived through Monday May 3 2021.

Thank you for your patience. Tax Year 2020 First Installment Due Date. Simplify Illinois sales tax compliance.

051122 Subtax may be paid by prior year tax buyers if going to deed. While taxes from the 2021 second installment tax bill which reflect 2020 assessments are usually due in August the due date was postponed until October 1st. 2021 Tax Year Calendar of Events in 2022.

050222 Drop Box. For more information see Bulletin FY 2022-14. The department is providing a printable image of the required sign.

IL-2021-07 December 22 2021 Victims of severe storms straight-line winds and tornadoes beginning December 10 2021 now have until May 16 2022 to file various individual and business tax returns and make tax payments the Internal Revenue Service announced today. Motor Fuel Retailer Sign - Effective July 1 2022 through December 31 2022 Public Act 102-0700 requires a notice to be posted in a prominently visible place on each retail dispensing device that is used to dispense motor fuel in the State of Illinois. Property tax bills mailed.

The original due date to file and pay Illinois individual income tax for calendar year filers is April 18 2022. 2022 Withholding Income Tax Payment and Return Due Dates Author. To make a payment online.

The second installment of the yearly property tax bills is typically due Aug. We provide sales tax rate databases for businesses who manage their own sales taxes and can also connect you with firms that can completely automate the sales tax calculation and filing process. 1 and with the exception of last years two-month COVID-19 delay has not been this late for roughly a.

060122 1st installment due date. 060222 Per Illinois State Statute 1½ interest per month due on late payments. 2021 Taxes Due 2022.

The filing deadline for Illinois individual income tax returns Form IL-1040 has been extended to May 17 2021. Taxpayers affected by the severe weather and tornadoes beginning December 10 2021 have been provided with an extension of time to file their 2021 IL-1040 until May 16 2022. 053022 MEMORIAL DAY - OFFICE CLOSED.

1st installment - Friday August 6 2021. The Illinois Department of Revenue IDOR is providing tax filing and payment relief to individuals by automatically extending the Illinois income tax filing due date for individuals for the 2020 tax year from April 15 2021 to May 17 2021. Welcome to Johnson County Illinois.

Under this system the first installment of taxes is 55 percent of last years tax bill. The 2021 pay 2022 Real Estate taxes-Will be in the mail May 27th 2022. The second installment to be mailed out by June 30 seeks the remaining amount of taxes due.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Mailing A Tax Return To The Irs Or Your State

2022 Tax Day When Will You Get Your Refund Here S What To Know Nbc Chicago

Illinois Sales Use Tax Guide Avalara

Tax Day 2022 What To Know Before You File Nbc Chicago

Illinois 2022 Primary Election Voter Guide Wbez Chicago

Prepare E File Your State And Irs Income Tax Returns Now

Tax Deadline 2022 How To Get An Extension To Due Date For Filing Return As Usa

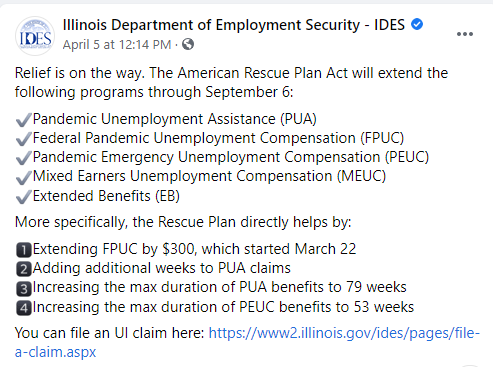

Illinois Il Ides Pandemic Unemployment Programs Expiry Pua Peuc Meuc And 300 Fpuc Retroactive Benefit Claim Payment Issues And Maximum State Unemployment Now Available Aving To Invest

Missouri Income Tax Rate And Brackets H R Block

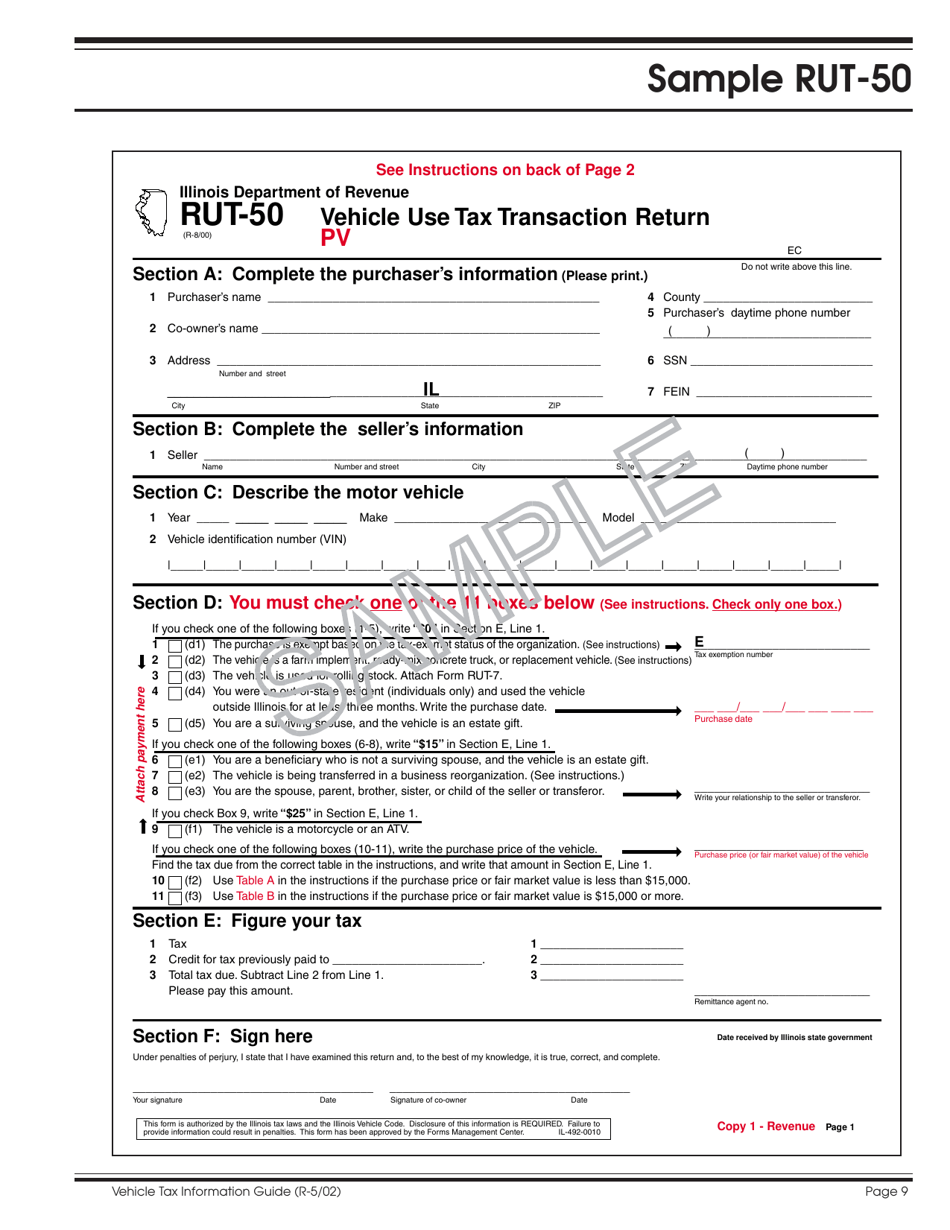

Illinois Car Registration A Helpful Illustrative Guide

Shrinking The Delaware Tax Loophole Other U S States To Incorporate Your Business

Gov Jb Pritzker Signs The 2022 Illinois Budget Including Tax Rebates

Sample Form Rut 50 Download Printable Pdf Or Fill Online Vehicle Use Tax Transaction Return Illinois Templateroller

Exempt Organization Income And Replacement Taxes

Stimulus Checks The States Releasing New Payments For May 2022 Marca

What Is Form 940 When Do I Need To File A Futa Tax Return Ask Gusto

/cloudfront-us-east-1.images.arcpublishing.com/gray/XLZKTQ2H3JGO3FSMINPOX3VFTA.jpg)