washington state capital gains tax unconstitutional

The issue in dispute is whether the capital gains tax is an excise tax or an income tax. The Center Square Douglas County Superior Court Judge Brian Huber ruled Tuesday afternoon that Washington states capital gains income tax is unconstitutional.

BIAW and the Washington Cattlemens Association filed a brief supporting the groups challenging the new tax.

. Last year the Democratically-controlled legislature passed and Gov. Created in 2021 the tax was ostensibly. Jay Inslee ruled in March that the tax on capital gains over 250000 a year is an income tax not as Democratic lawmakers had argued an excise.

Washington Senate Passes Unconstitutional Capital Gains Income Tax Matt Owens 03312021 Washington State is considering a new capital gains tax SB 5096 that would levy a 7 percent tax on profits from selling stocks bonds and other assets. Washingtons New Capital Gains Tax is Overturned as Unconstitutional. Here the capital gains tax does not apply to everyone and therefore is not uniformly applied.

GeekWire Photo John Cook A new capital gains tax in Washington was ruled unconstitutional by a lower court judge on Tuesday likely sending the. When signed Washington became the first state in the country with no. BIAW celebrated a huge victory in the courts when a superior court judge ruled Washingtons controversial capital gains income tax was unconstitutional.

On March 1 2022 the Douglas County Superior Court ruled that Washingtons new capital gains tax is unconstitutional. In March of 2022 the Douglas County Superior Court ruled in Quinn v. In April 2021 the Freedom Foundation an Olympia-based think tank filed a lawsuit against the new tax alleging it violates the state constitution as well as the Commerce Clause of the US.

The judge Brian Huber a 2019 appointee of Gov. On March 1 2022 Douglas County Superior Court Judge Brian Huber overturned Washington states capital gains income tax as unconstitutional. The measure adds a 7 tax on capital gains above 250000 a year such as profits from stocks or business sales.

OLYMPIA The state Supreme Court has agreed to hear a lawsuit regarding Washingtons new capital gains tax. If the capital gains tax is an income tax and I think it is then it would be unconstitutional under the Washington Constitution. In 2021 Washington State Legislature passed ESSB 5096 which created a 7 tax on the sale or exchange of long-term capital.

The law went into. The tax enacted in 2021 would have imposed a seven percent tax on long term capital gains over 250000 reported by Washington residents and other individuals on their federal income tax returns. Judge Huber held that the CGT wasnt uniform because the 7 rate applied to capital gains exceeding 250000 while gains below this threshold were taxed at 0.

The State has appealed the ruling to the Washington Supreme Court. If passed Washington will be the only state without an income tax with a standalone capital gains tax. It violates the uniformity requirement by imposing a 7 tax on an individuals long-term capital gains exceeding 250000 but imposing zero tax on capital gains below that 250000 threshold.

The Washington State capital gains tax which went into effect on January 1 2022 has been held unconstitutional by the Douglas County Superior Court. The plaintiffs argued the tax is unconstitutionally labeled as an excise tax when it is really an income tax. The lawsigned by Governor Jay Inslee last Mayimposes a 7 tax on the sale of stocks bonds and other assets above 250000.

The Washington state capitol in Olympia Wash. State of Washington that the capital gains excise tax ESSB 5096 does not meet state constitutional requirements and therefore is unconstitutional and invalid. In his March 1 ruling Douglas County Superior Court Judge Brian Huber wrote.

It violates the uniformity requirement by imposing a 7 tax on an individuals long-term capital gains exceeding 250000 but imposing zero tax on capital gains below that 250000 threshold the. 1 According to the court the tax is subject to the constitutional requirements because it is properly characterized as an income. Created in 2021 the tax was ostensibly labeled an excise tax in an effort by the Washington State Legislature Legislature to avoid difficulties associated with implementing an income tax in the state of.

The Constitution provides that all taxes on property must be uniformly applied and cannot exceed an annual rate of 1. This Court concludes that ESSB 5096 violates the uniformity and limitation requirements of article VII sections 1 and 2 of the Washington State Constitution. A Douglas County Superior Court judge in March struck down the new tax which.

Jay Inslee signed into law a capital gains tax aimed at the states wealthiest residents. The Washington State capital gains tax which went into effect on January 1 2022 has been held unconstitutional by the Douglas County Superior Court. The Washington State capital gains tax which went into effect on January 1 2022 has been held unconstitutional by the Douglas County Superior Court.

The Superior Court of Douglas County Washington recently held that the long-term capital gains LTCG tax on individuals enacted by the state in 2021 violates the uniformity and limitation requirements of the Washington State Constitution. ESSB 5096 is properly characterized as an income tax pursuant to Culliton Jensen Power and other applicable Washington caselaw rather than as an excise tax as argued by the State Huber. Constitution by taxing the sale of capital gains held out-of-state by Washington state residents.

Having established the CGT as an income tax and therefore a property tax the court found it was subject to the uniformity provisions of the Washington Constitution.

Capital Gains Tax Heads To Inslee S Desk After Passage In Washington Legislature The Spokesman Review

Mississippi Kept Blacks From Voting With A Jim Crow State Constitution In 1890 The Washington Post

Washington State Senate Leader Grilled Over Abandoned Police Pursuit Bill Local Bigcountrynewsconnection Com

Why Is There No State Income Tax In Washington How Are State Expenses Met Quora

Foes Of State S Capital Gains Tax Drop Plans For Initiative Renton Reporter

Initiative To Repeal Capital Gains Tax Stalls In Washington State Axios Seattle

Your Only Chance To Opt Out Of Washington S New Long Term Care Tax Is Fast Approaching Puget Sound Business Journal

State Supreme Court Upholds B O Tax On Large Banks In Washington Mynorthwest Com

For The Tenth Straight Year Washingtonians Will See Anti Tax Propaganda On Their Ballots Npi S Cascadia Advocate

Are Taxes Withheld On Home Sale Washington State Destinationpackwood Com

Washington Supreme Court Will Hear Capital Gains Income Tax Case Law Ontownmedia Com

Are Taxes Withheld On Home Sale Washington State Destinationpackwood Com

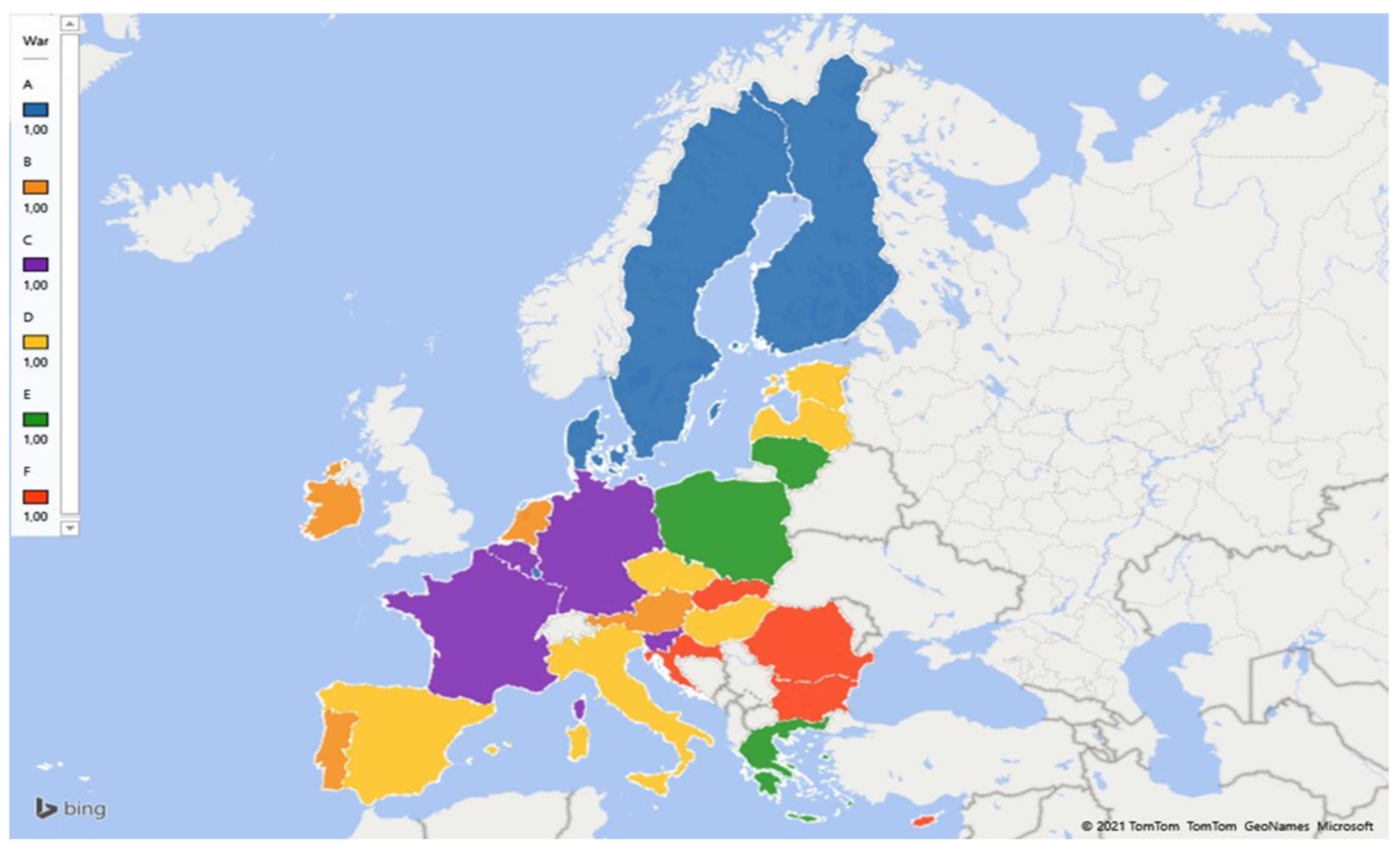

Sustainability Free Full Text Determinants Of Inclusive Growth In The Context Of The Theory Of Sustainable Finance In The European Union Countries Html

Judge Overturns Washington State S New Capital Gains Tax

Blair Minniti Partner Moss Adams Llp Linkedin

Realizing Deemed Income From Holey New Taxes

Capital Gains Tax Heads To Inslee S Desk After Passage In Washington Legislature The Spokesman Review